Customer journey

The HSBC Customer Journey we mapped for online business acquisition in Hong Kong.

HSBC has a substantial advantage in it’s biggest markets, being perceived as a global bank that can act as a bridge between Asia and the world.

They provide essential services for small businesses in places like Hong Kong and Singapore, yet getting a bank account is still considered one of the hardest parts of starting a business.

Disconnected journeys, varied digital capabilities, siloed organisations, and complex regulatory environments all impact the experience for customers, negating the trust and reputational advantages HSBC holds.

As a result, HSBC was missing opportunities to connect with a new generation of startups and founders, with friction during the digital and retail acquisition processes pushing business owners to turn to faster moving fintechs and competitors.

The HSBC Customer Journey we mapped for online business acquisition in Hong Kong.

We collaborated with HSBC and MullenLowe Group teams in Hong Kong, Singapore, and the United Kingdom to redesign the customer journey for businesses getting an HSBC account.

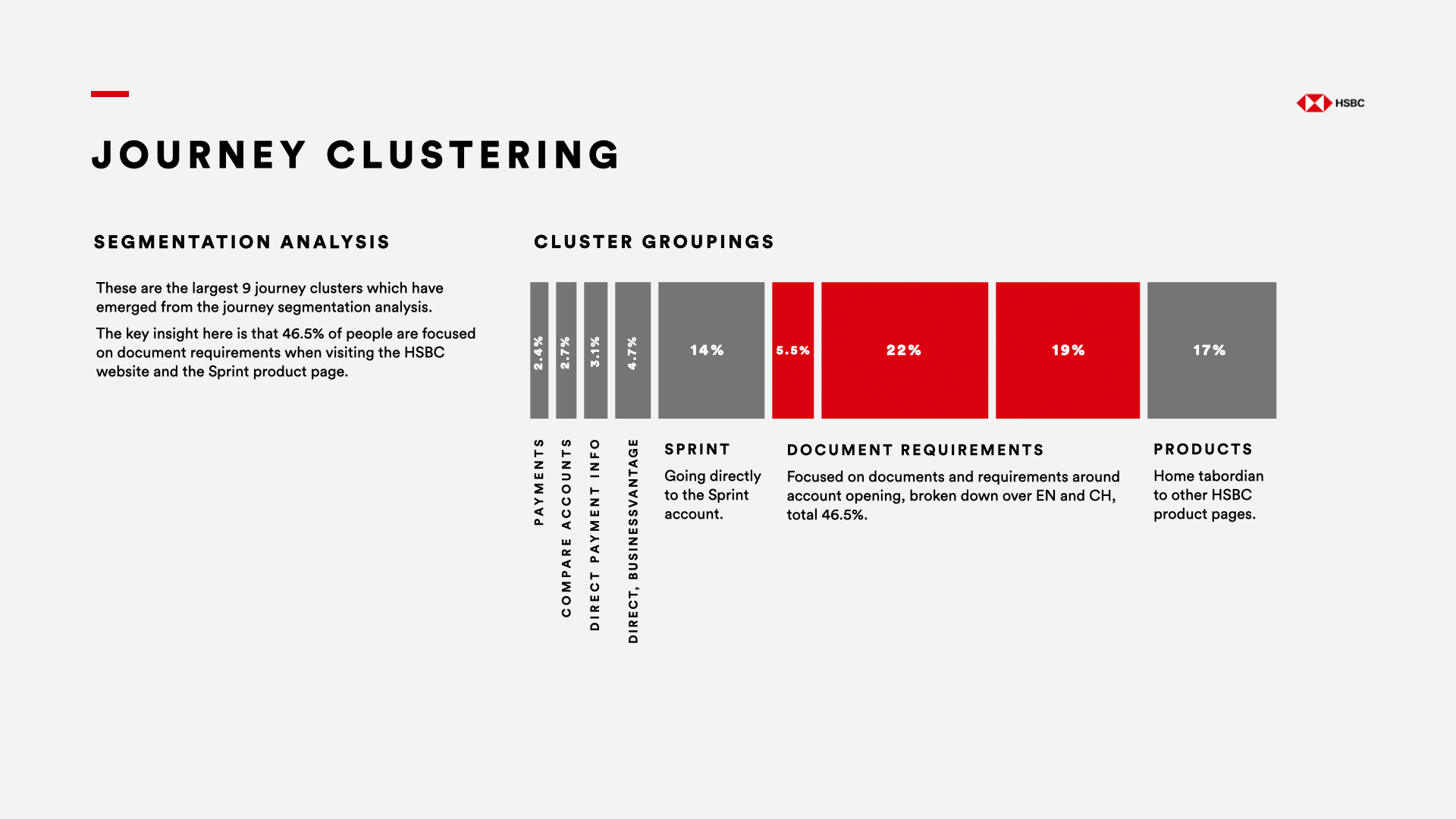

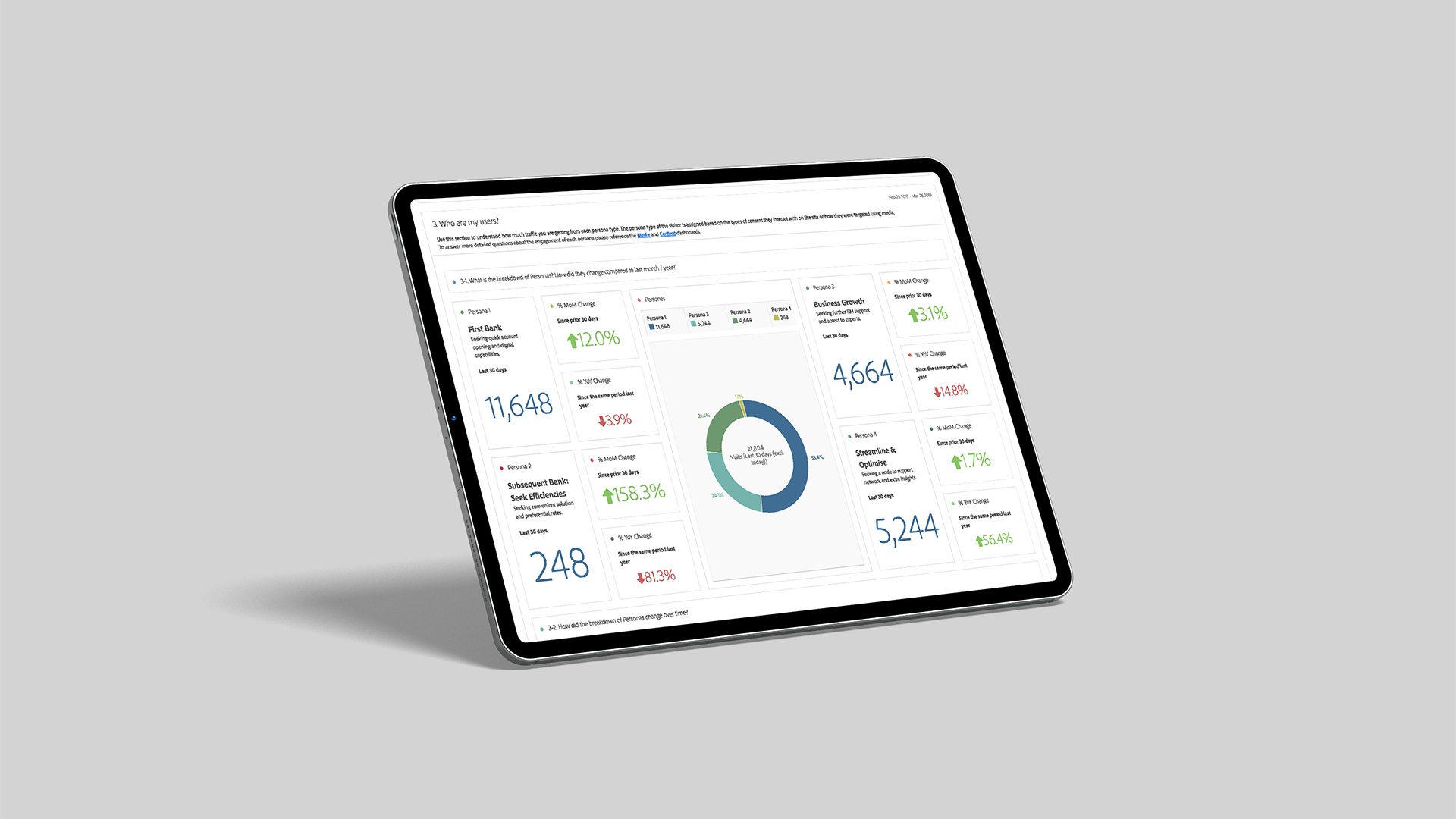

A key business objective was to use emerging data capabilities to optimise the digital journey, personalising the experience to provide targeted storytelling and service offerings for different kinds of business customers.

Our extensive research process in each market included:

Through this we identified critical insights based around customer mindsets and jobs to be done at each point in the journey. These were then mapped to business objectives and digital capabilities, with test and learn experiments conducted over several months on HSBC platforms.

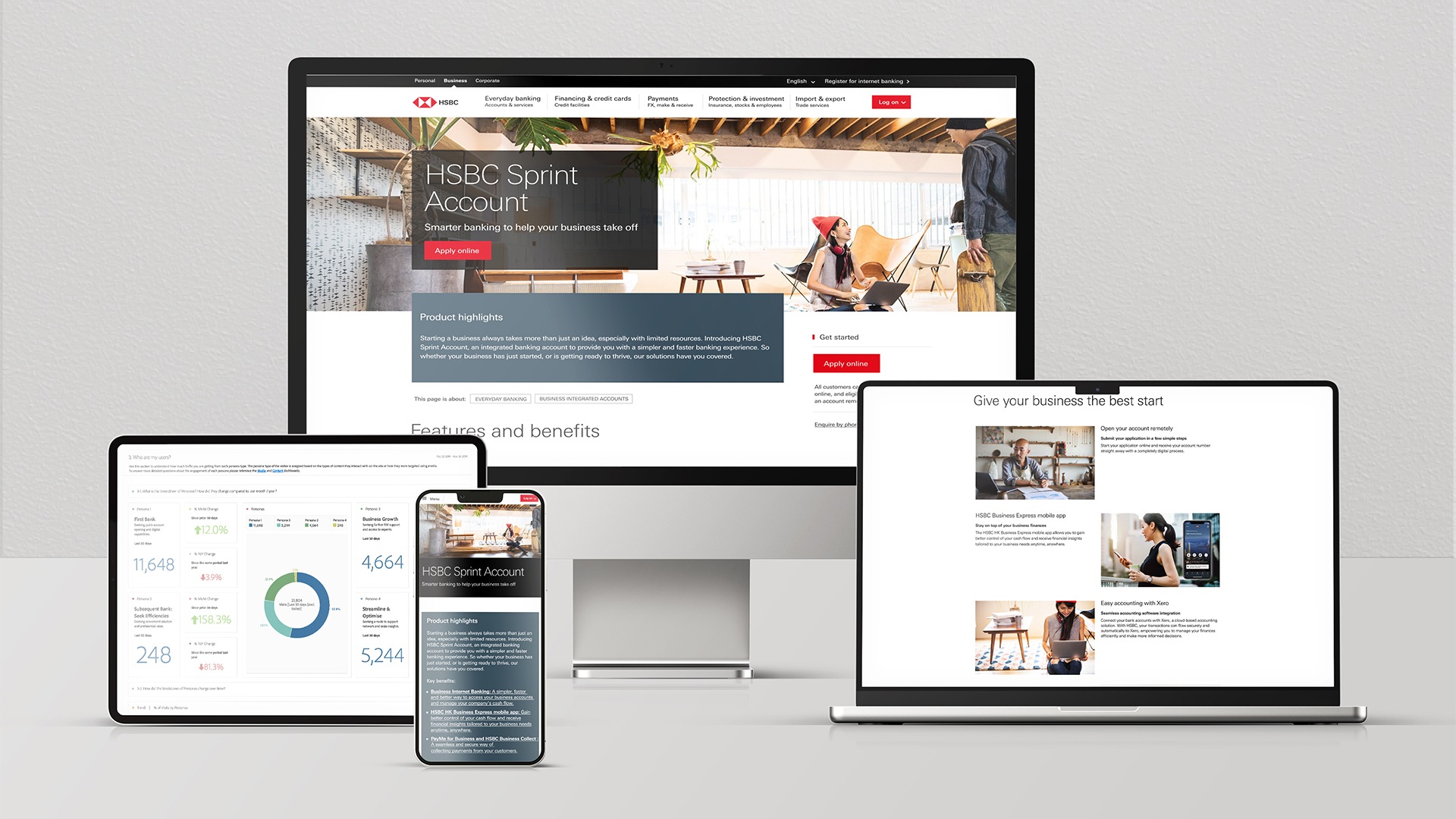

Prototypes of different touchpoints delivered across markets, including digital experiences in Hong Kong and the UK, and a banker dashboard in Singapore.

Increase in online business applications in the United Kingdom.

Months to hit annual business targets in Singapore.

Uplift in online conversion for Sprint Business Account in Hong Kong.

Across these markets we significantly improved HSBC business acquisition numbers, with a 38.5% increase in applications in the UK, annual targets hit within 6 months in Singapore, and a 21% uplift in online conversion in Hong Kong.

Together these three markets make up around 50% of HSBCs global revenue, with $6.8b in Hong Kong, $5.0b in the UK, and $0.8b in Singapore in 2022.

This was achieved by localising the experience for customers in each market, connecting data sources across the journey and showing HSBC where to prioritise investment decisions.

In the UK this pointed to a largely digital strategy, with an end-to-end personalised journey tied to open banking and other digital advances.

In Singapore personalisation meant more of a physical experience where customers could connect with a trusted banker, providing these bankers with business intelligence to support the journey.

And in Hong Kong we were helping businesses operate in a complex set of global, Chinese, and local financial platforms and systems.

Learn more and see the latest iterations of these experiences at HSBC Hong Kong, Singapore, and the United Kingdom.

A special thank you to all contributors to the program.

Samuel Christian

Business Director

Nico Leonard

Experience Design Director

Hugo Wong

UX Designer

Jonathan Hart

Head of Data Science and Analytics

Chris Rogers

Data Scientist

Radhe Vaswani

Chief Operating Officer, APAC

MullenLowe Profero UK

HSBC Singapore

HSBC Hong Kong