Tracking your carbon footprint

Cogo integrates with banking apps and calculates your carbon footprint based on your transactions, providing nudges towards more sustainable behaviours.

Cogo is a carbon footprint management product that helps individuals and businesses to measure, understand, and reduce their impact on the climate.

For their Japan market entry, Cogo were looking to understand the how the financial services landscape is distinct from places like New Zealand, Australia, Singapore, and the United Kingdom where they’d already delivered their solutions successfully.

Japan has a series of challenges for fintechs to navigate – from slow moving financial institutions to fragmented payment methods, trust and privacy expectations, shifts in sustainability consciousness, and a rapidly ageing population.

Cogo were looking for a partner to increase their understanding of both how to influence Japanese banks, and the extent to which customers are ready for carbon tracking in their financial apps.

Cogo integrates with banking apps and calculates your carbon footprint based on your transactions, providing nudges towards more sustainable behaviours.

We collaborated with the Cogo team to conduct a research study into the intersection between financial and sustainability behaviours in Japan.

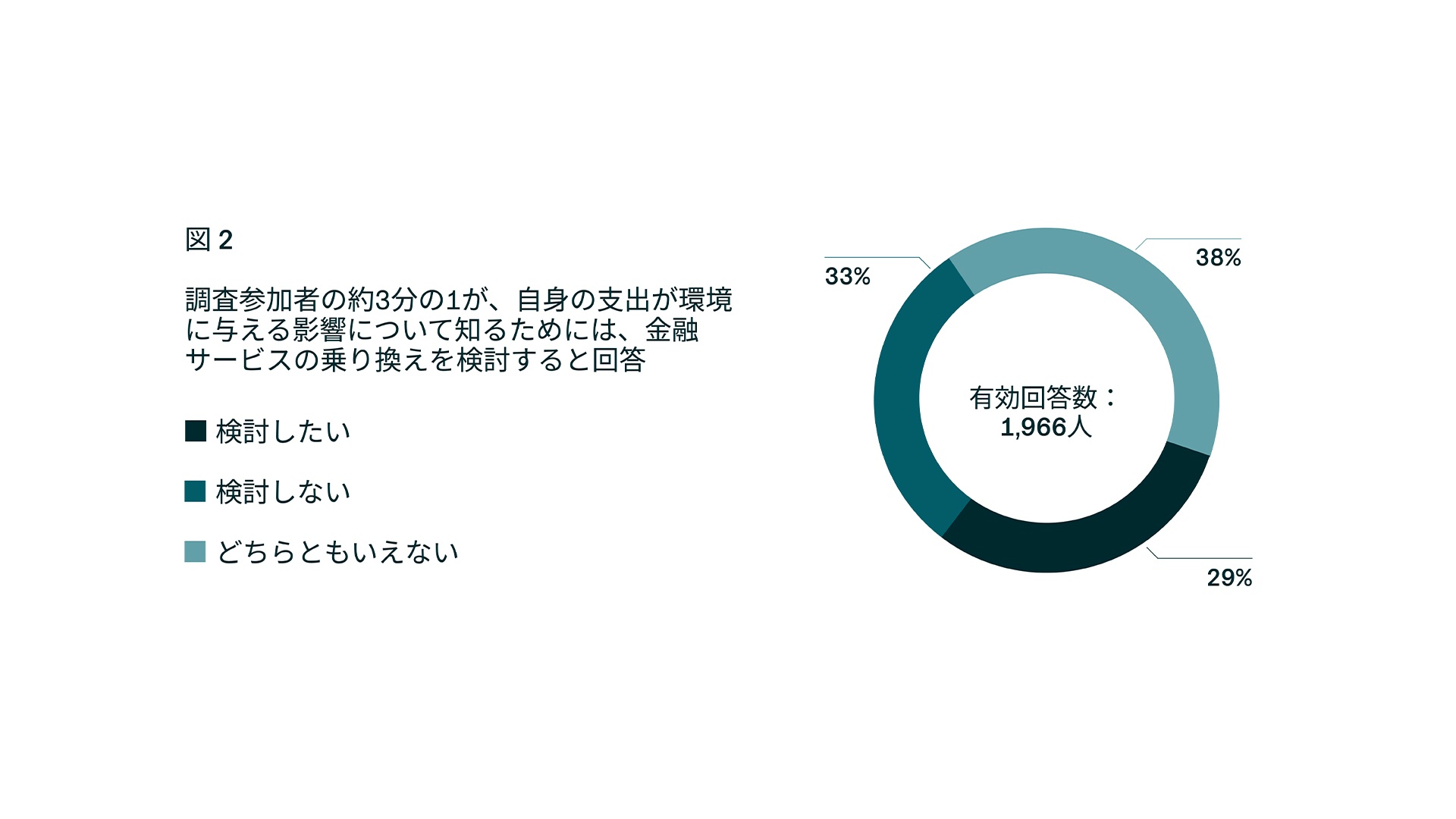

This was mainly a quantitative study conducted with a representative group of 1966 participants in Japan who use bank and financial apps, supported by additional research and synthesis to expand on our findings.

Our activities and synthesis during the study were focused on:

Bank and financial app users in Japan would like their apps to help them measure their carbon footprint (after viewing Cogo UX).

People expect their banks and card providers to do more to reduce their climate and environmental impact.

People have already made changes to their lifestyles to reduce their climate and environmental impact.

Interested in points and offers for making sustainable choices.

The study found there is an unmet need for sustainable products in the financial services industry, with a rise in conscious behaviours, and a high desirability for tools like carbon footprinting.

Cogo were able to use the insights from the study to adapt their strategy for Japan, with insights around the complexity of the payment landscape informing a change in the banks and fintechs they were targeting.

When engaging with a prototype of the Cogo user experience a large cohort of people shifted from neutral to positive in their responses, with nearly 40% of participants wanting the feature in their financial apps. Significantly for the Cogo business case, 41% expect their banks to do more to reduce their climate and environmental impact.

Download the research summary from the Cogo website.

Get in touch if you’re interested in partnering with Cogo and would like an introduction to the team.

A special thank you to all contributors to the program.

Nico Leonard

Strategic Design Director

Ai Yamanaka

Senior Strategic Designer

Kentaro Sekine

Senior Program Manager

Jeffery Phonn

Data Strategist

Jiro Tatsuno

Business Director

Kaz Udagawa

Japan Country Head

Josh Dry

Director Enterprise Solutions & Partnerships, North America & Asia-Pacific

Verena Wimmer

Head of Behavioural Science & Insights

Tu Vy Do

Behavioural Science Researcher

Jody Boshoff

PR Manager APAC

Julie Lindenberg

CEO APAC